FIXED ASSET CALCULATION

DESCRIPTION: Fixed Asset Calculation will calculate the depreciation for fixed assets. This can be done monthly or at your fiscal year end.

To access: Click on the Fixed Assets module .png) then click the Fixed Asset Calculation menu item.

then click the Fixed Asset Calculation menu item. ![]()

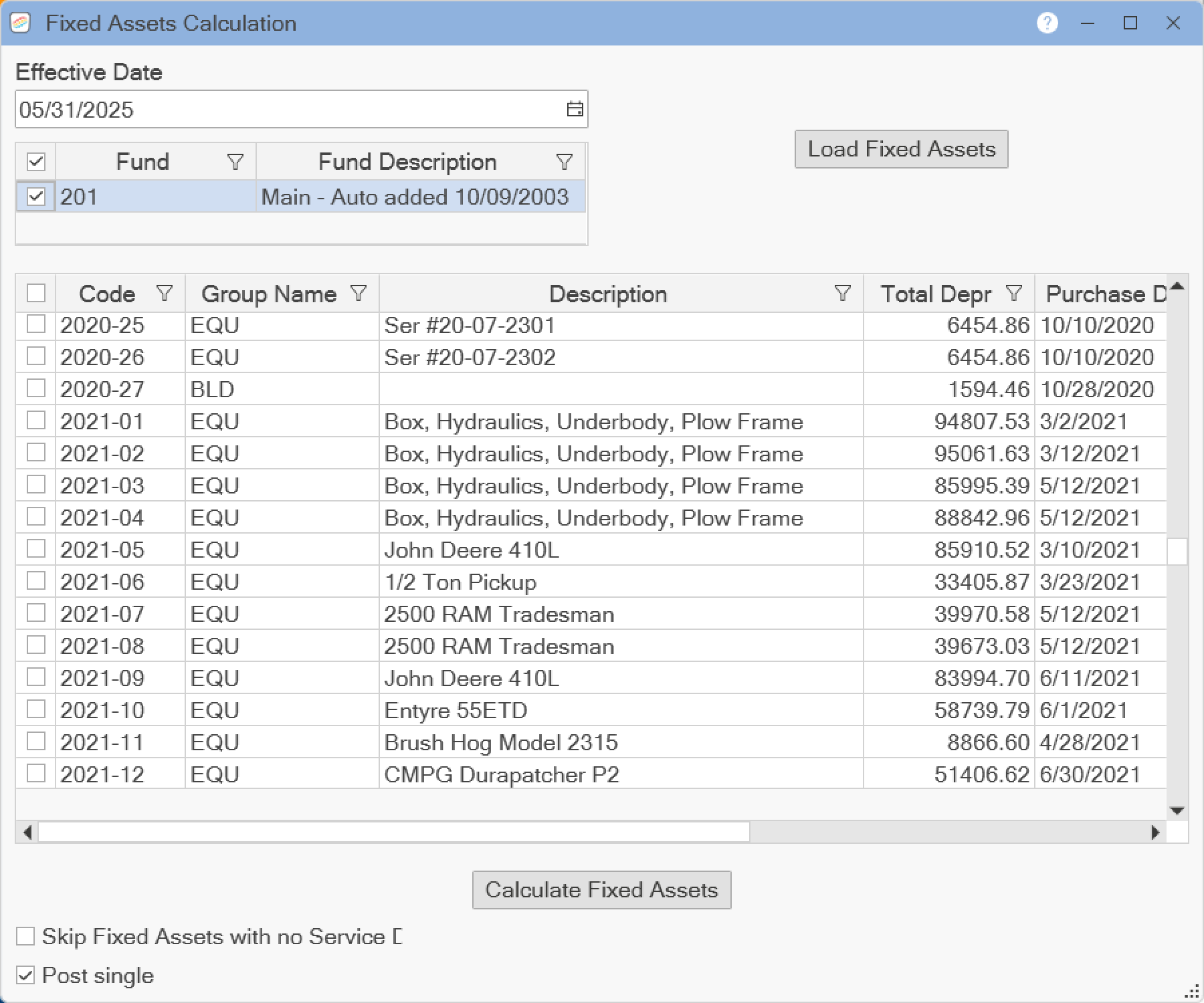

The following window will appear:

Please see the following topic for help on setting up filters ![]() in the grid: Exploring Grid Filters

in the grid: Exploring Grid Filters

Select the Effective Date that you want to have the fixed assets calculated through. You can type in the date or click the Calendar button to select the date. Select the Fund that you would like to view. Then click the Load Fixed Assets button to see the fixed assets that are linked to the selected fund. You may limit which fixed assets are displayed by clicking on the Filter ![]() symbol on the right side of each column header. To select or deselect a specific fixed asset, click on the check box on the left side of the row. To select all the visible fixed assets, click on the check box next to the Code column.

symbol on the right side of each column header. To select or deselect a specific fixed asset, click on the check box on the left side of the row. To select all the visible fixed assets, click on the check box next to the Code column.

Check the Skip Fixed Assets with no Service Date box if you have added new fixed assets that are being improved before depreciation starts. If you check this box, then any fixed assets that do not have an in-service date specified will not be calculated. Check the Post single box if you would like one cumulative entry posted to your general ledger for each fixed asset. Otherwise, a monthly entry is made for each fixed asset.

Click the Calculate Fixed Assets button to calculate your depreciation. If there are any fixed assets which will have calculations before the start of the current fiscal year, a message window will appear indicating this. If you are sure you would like to proceed with calculating fixed asset depreciation from a previous fiscal year, then click OK to continue. If you continue, fixed assets calculations from previous fiscal years will be posted to the first day of the current fiscal year. When the calculation is done, a window will appear displaying the journal number of your entries. Save this number for future reference. Click the OK button and the window will close.

Click on the X in the upper right corner of the window to close the window.