PAYROLL YEAR DATES

DESCRIPTION: Payroll Year Dates allows you to specify the starting earning date for the New Year.

To access: Click on the Payroll module .png) then click the Payroll Year Dates menu item.

then click the Payroll Year Dates menu item. ![]()

The following window will appear:

.png)

To enter a New Year, click the New button. The New Year will show up at the bottom of your list. Scroll down and double click on the date. Enter the correct date, then click the Done button. If you do not specify a date for the New Year, Pro Fund Accounting will default to January First as the starting earning date. MAKE SURE TO VERIFY THAT THIS INFORMATION IS CORRECT. The start date is the first day of payroll that will be paid in the new calendar year.

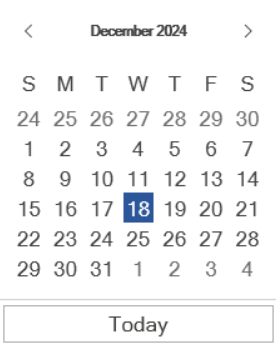

To edit the date, click on the line entry you want to edit. Then double click on the appropriate cell you want to modify and either hand enter the date, or click on the calendar button to select the appropriate date.

To Delete a Payroll Year Date, click on the line entry you want to delete. Click on the Delete button.

NOTE: Only delete an entry if you initially entered it wrong. Once you have done your quarterly tax reports, you should NOT delete a payroll year date.

You will receive the following message window: Are you sure you want to delete the selected item? Click Yes to delete the line; click No to return to the Payroll Year Dates window.

Click the Done button to save any changes and close the window.