EXPLORING THE DIFFERENT SCREENS

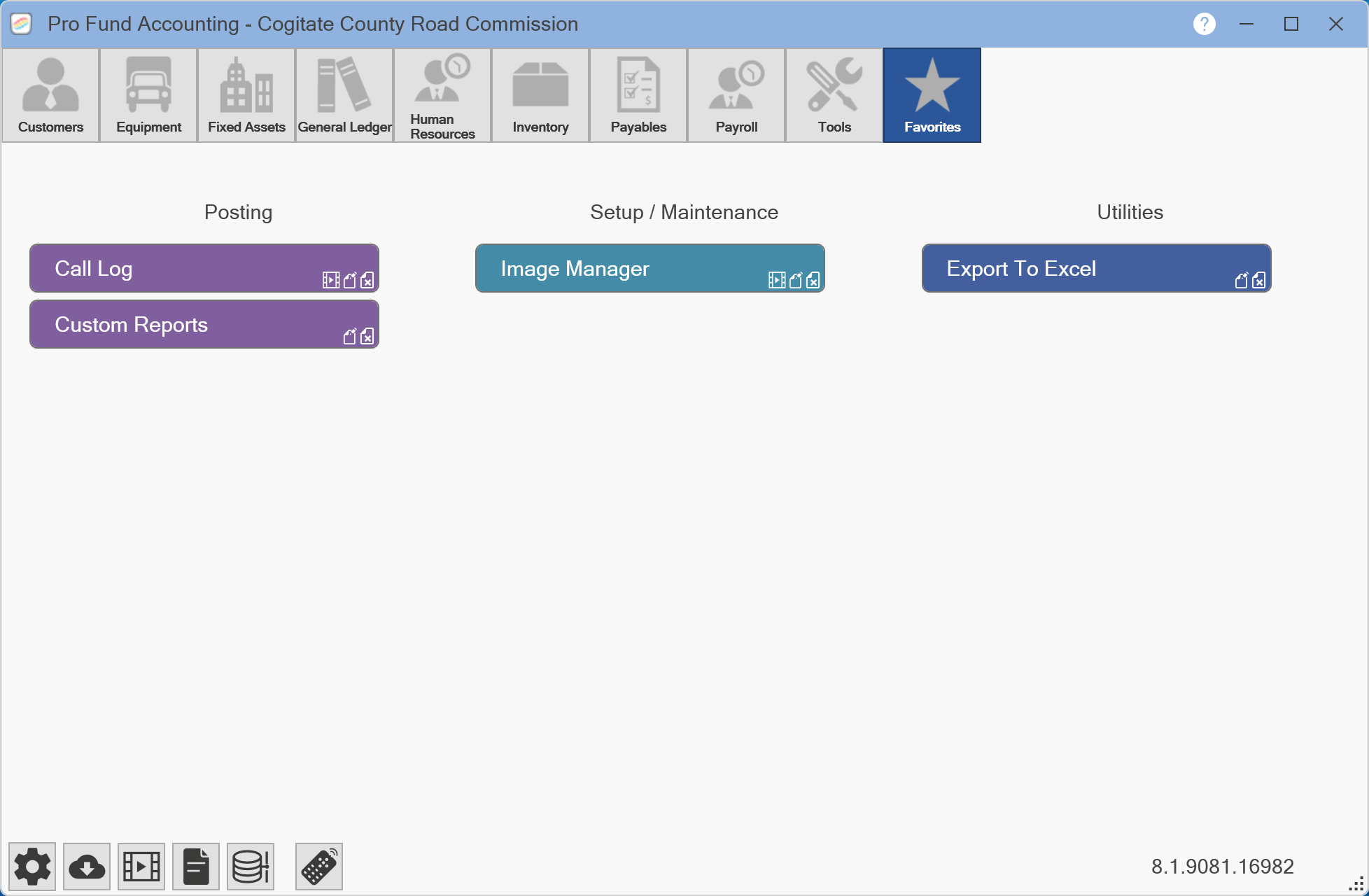

Pro Fund Accounting has many program modules available. NOTE: You will only have access to the modules you have purchased. Also, certain modules may not be seen based on your security settings. The buttons that are used to quickly access the program modules are as follows: Customers, Equipment, Fixed Assets, General Ledger, Human Resources, Inventory, Payables, Payroll, Tools, and Favorites.

The Menu Items are the different actions under each module. On each one of the menu items, there may or may not be the following: ![]() The movie icon means there is a help video available. The icon with the pencil on it, if showing, means that you can CREATE and EDIT anything under that topic. If it's not there, you only have READ ACCESS. The icon with the 'X' in it, if showing, means you have DELETE functions under that topic. If it's not there, you can't delete anything.

The movie icon means there is a help video available. The icon with the pencil on it, if showing, means that you can CREATE and EDIT anything under that topic. If it's not there, you only have READ ACCESS. The icon with the 'X' in it, if showing, means you have DELETE functions under that topic. If it's not there, you can't delete anything.

At the bottom of the Main Screen is the Lower Status Bar which includes the following buttons: Settings, Check For Updates, Training Videos, Release Notes, About Information, and Remote Access.

Information on the Settings button ![]() can be found under Settings.

can be found under Settings.

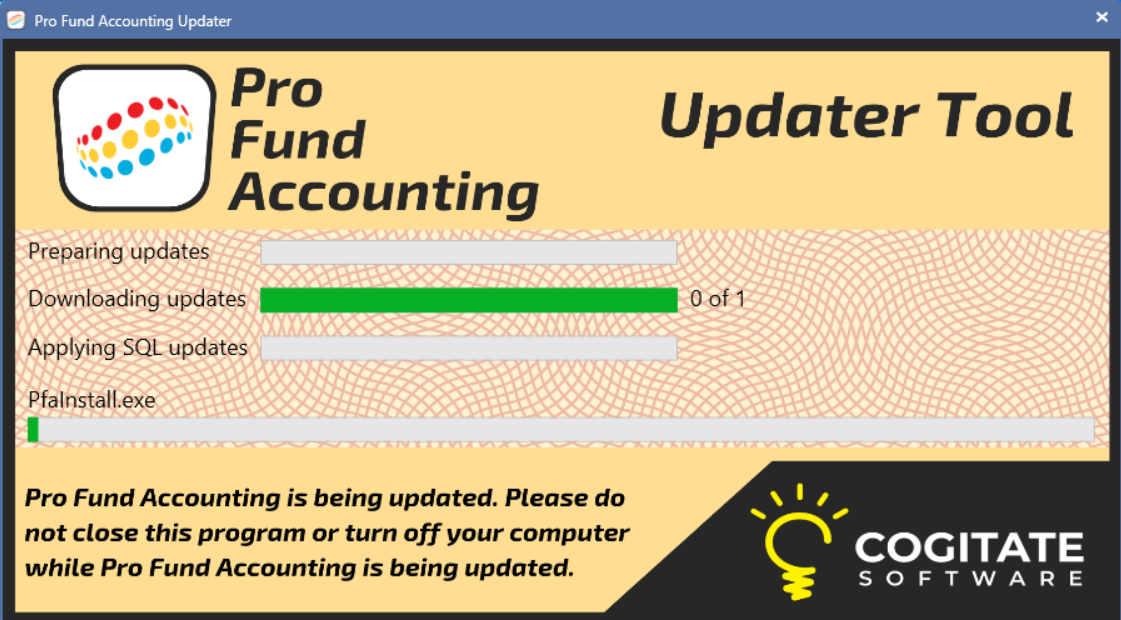

The Check For Updates button ![]() gives you confirmation that everything has been updated, or if there were problems during the update. If you are an administrator, you will have to update your computer first when there is a new update. A confirmation screen asking whether you want to allow the software to make changes to your device will appear on the screen. Click YES to continue the update process; click NO to not update at this time. The Pro Fund Accounting Updater will then run and show progress bars as seen below:

gives you confirmation that everything has been updated, or if there were problems during the update. If you are an administrator, you will have to update your computer first when there is a new update. A confirmation screen asking whether you want to allow the software to make changes to your device will appear on the screen. Click YES to continue the update process; click NO to not update at this time. The Pro Fund Accounting Updater will then run and show progress bars as seen below:

When the Updater is finished, a confirmation screen will appear letting you know all your updates were successfully applied.

Once you select OK, the program will automatically close and you will need to log back in.

The Training Videos button ![]() allows you to watch some of our helpful training videos by clicking on the appropriate item. You will then be directed to the appropriate place on the Pro Fund Accounting website.

allows you to watch some of our helpful training videos by clicking on the appropriate item. You will then be directed to the appropriate place on the Pro Fund Accounting website.

The Release Notes button ![]() allows you to view the latest (or past) update information made to the Pro Fund Accounting software.

allows you to view the latest (or past) update information made to the Pro Fund Accounting software.

The About Information button ![]() gives the current database connection information.

gives the current database connection information.

The Remote Access button ![]() allows Cogitate Inc. support to provide remote assistance.

allows Cogitate Inc. support to provide remote assistance.

If you happen to have left a journal pending, it will show in the center of the Lower Status Bar.

![]()

THE FOLLOWING IS A LOOK AT ALL THE DIFFERENT MODULES AVAILABLE .

.png)

CALL LOG: An organizational tool used to log calls received from residents.

CALL LOG REPORTS: These are reports related to the Call Log menu item.

CASH RECEIPTING: Allows you to enter and print receipts for your customers when receiving non-accounts receivable cash payments.

CUSTOMERS REPORTS: Choose which report you want to run/print.

INVOICE POST: Post invoices using accounts receivable bill codes that have been set up in the Bill Codes menu item.

PAYMENT POST: This menu item is used to apply payment to invoices and designate how the payment will be distributed. Prepayments for invoices that have not yet been issued can also be posted.

BILL CODES: Allows you to enter (set up, view, and modify) recurring billing information for use in cash receipting and accounts receivable.

CALL LOG CONTACTS: Set up, view, and modify contact information for the Call Log menu item.

CUSTOMERS: This menu item is used to set up and update information for all customer accounts that will be sent invoices or regular cash receipts.

PULL DOWN ITEMS: Provides the ability to specify the items to show in pull down, drop down, or combo box lists throughout Pro Fund Accounting.

ROAD NAMES: Used to set up, view, and modify road names and their corresponding road segments for the Call Log system.

APPLY CREDIT BALANCES: This menu item finds available credit balances in a customer's accounts receivable account and applies it to any open invoices in the same account.

.png)

EQUIPMENT QUESTIONNAIRE CALC: This is used to compile information for the equipment questionnaire to report to the Michigan Department of Transportation. The Fixed Asset Calculation must be completed before running this menu item.

EQUIPMENT REPORTS: Choose which reports you want to run/print.

EQUIPMENT WHEEL HOUR CALCULATION: This is used to calculate wheel hour cost and distribute it to equipment records.

WORK ORDER CALC: This is used to create work orders based on the preventative maintenance settings and meter readings for equipment. The meter reading history and all preventative maintenance information needs to be up-to-date before using this tool.

EQUIPMENT: This is used to track charges and usability of a piece of road equipment over its life.

EQUIPMENT RENTAL UPDATE: This is used to update the local and state rental rates for equipment. The rates used are the Schedule C rates provided by the Michigan Department of Transportation.

PULL DOWN ITEMS: Provides the ability to specify the items to show in pull down, drop down, or combo box lists throughout Pro Fund Accounting.

WORK ORDERS: Examine and modify work orders generated by the Work Order Calc menu item.

CHANGE EQUIPMENT CODE: This is used to change or modify the equipment code and history to something different.

IMPORT FUEL READINGS: This allows you to import fuel usage data from your fuel tracking system into Pro Fund Accounting.

IMPORT METER READINGS: This is used to import meter readings from an Excel spreadsheet into Pro Fund Accounting.

.png)

FIXED ASSET CALCULATION: This will calculate your fixed asset depreciation and post all entries to the General Ledger. This can be done monthly or at your fiscal year end.

FIXED ASSETS REPORT: Choose which reports you would like to run/print.

FIXED ASSETS: This is used to set up and store information on your fixed asset purchases and disposals. This can include large assets like trucks or smaller assets like a computer.

CHANGE FIXED ASSET CODE: Utility that allows you to change the code you use for any fixed asset.

.png)

BANK RECONCILIATION: This menu item is used to reconcile your bank statements.

BUDGET CALC: This menu item gives you the opportunity to put together detailed, personalized budget comparison spreadsheets.

GENERAL LEDGER POST: Post Transfer Vouchers, Budget Items, and General Journal Entries.

GENERAL LEDGER REPORTS: Choose which reports to run/print.

MAKE DEPOSITS: Allows you to group cash receipts and payments together to form a single deposit to your bank account.

POSITIVE PAY: This utility is a fraud prevention system offered by most commercial banks to protect against altered, forged, or counterfeit checks. When a check is presented for payment, it verifies the accuracy of the account number, date, and dollar amount.

POST BALANCES FORWARD: This is the process of closing your current fiscal year and opening a new fiscal year.

STATE TRUNKLINE UPDATE: This menu item processes all the data for the current period to produce a billing file that can be sent to the Michigan Department of Transportation.

STATE TRUNKLINE YEAR-END ADJUSTMENT: This menu item is used to calculate year end adjustments for state trunkline labor and equipment expenses.

ACCOUNTS: This menu item is used to enter and manage the chart of accounts required by Pro Fund Accounting.

FINANCIAL INSTITUTIONS: Used to manage information about your accounts at financial institutions.

FINANCIALS: This menu item is where you can input a budget and set up a balance sheet for a fund.

FUNDS: This menu item is used to specify the internal accounts for your funds.

JOB TYPES: This menu item is used to set up a specific job for job costing purposes. Before using job costing, be sure to turn on the USED JOB option in the Settings system.

SOURCE OF ENTRY: This menu item is used to set up and modify the details of each source of entry for transactions posted.

STATE TRUNKLINE BUDGET: This menu item is used to maintain state trunkline budget items in accordance with the state issued budget.

CHANGE ACCOUNT NUMBER: This utility will change all the transactions from the existing account number to the new account number including all the previous history in Pro Fund Accounting.

CHANGE JOURNAL EFFECTIVE DATE: This utility will change a journal's effective date for all the transactions in the journal that have that date.

COST OF ROADS SPREAD: Calculation process to spread the cost of roads over applicable account numbers.

FINANCIAL STATEMENTS: Displays a balance sheet, budget detail, profit and loss, and the monthly budgets all in one Excel formatted document.

FRINGE BENEFITS SPREAD: This menu item will spread the fringe benefits you pay for your employees to all accounts within the designated limits.

SQUEEZE JOURNAL NUMBERS: This utility is typically used when you have inadvertently used a very high journal number (one that is out of sequence with all the others) and will squeeze all the journal numbers and get them in line again. It can only squeeze journal numbers from Accounts Payables, Inventory, and Payroll menu items.

UNDO DEPOSITS: This utility will remove a deposit from your bank account and unmark the items that were deposited.

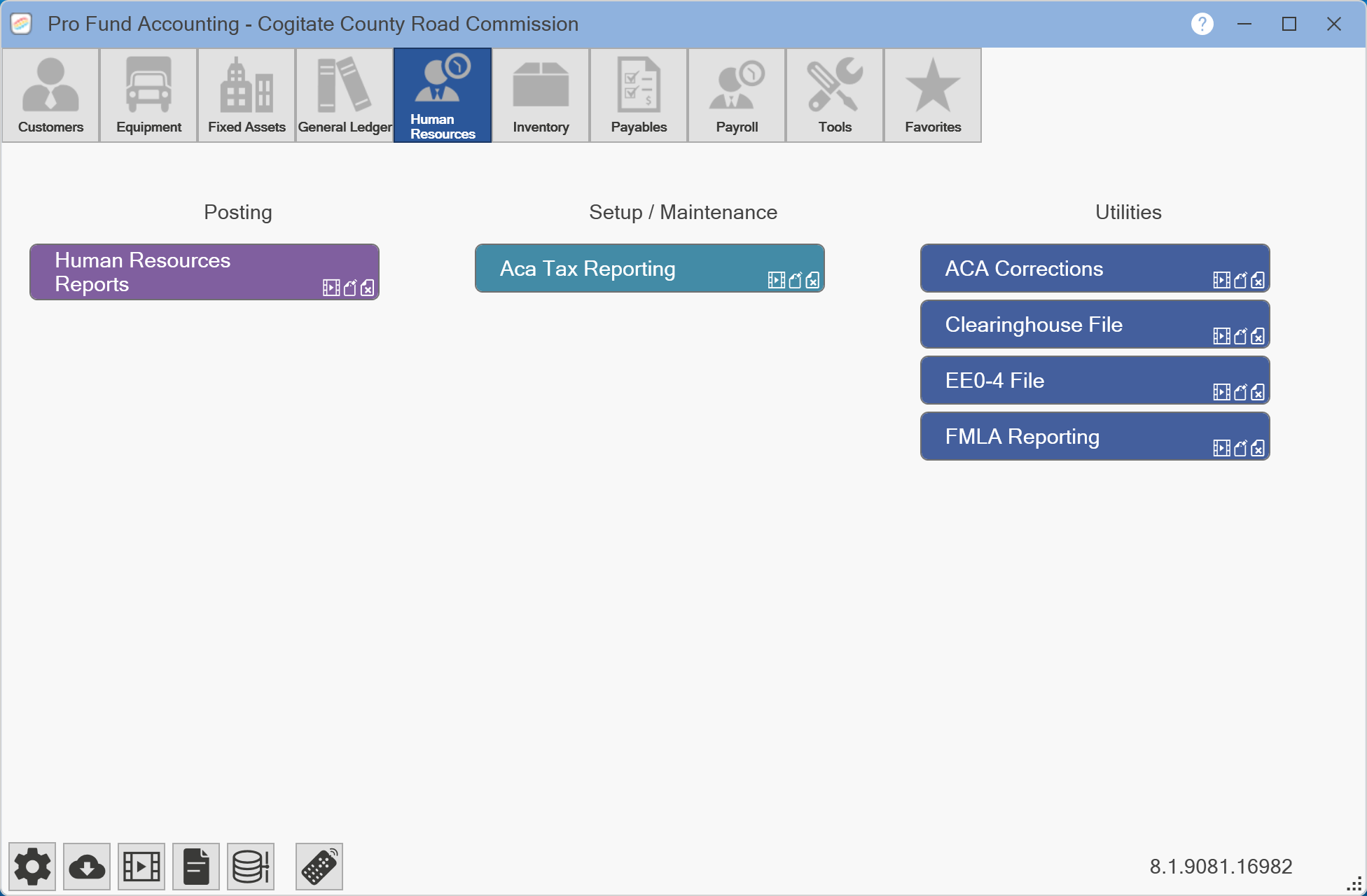

HUMAN RESOURCES REPORTS: Choose which reports you want to run/print.

ACA TAX REPORTING: This is used to manage records of employee health care plans and to generate Affordable Care Act reports required by the IRS.

ACA CORRECTIONS: Allows you to create ACA correction files to efile with the IRS.

CLEARINGHOUSE FILE: This is used to create the drug and alcohol clearinghouse upload file for the Federal Motor Carrier Safety Administration.

EEO-4 FILE: Compiles demographic workforce data including data by race, ethnicity, sex, job category, and salary band.

FMLA REPORTING: Generates the required submission files for the Family and Medical Leave Act.

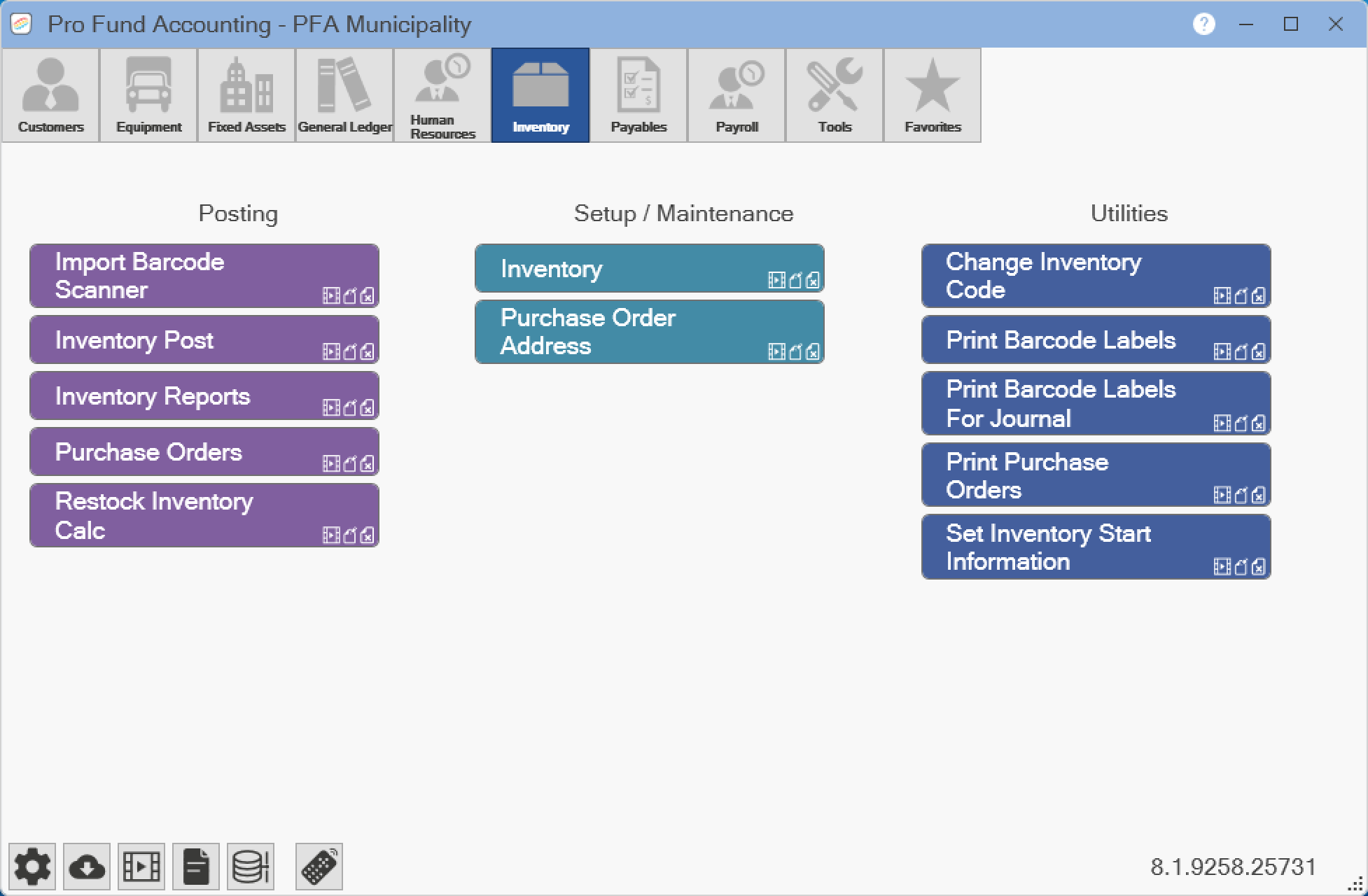

IMPORT BARCODE SCANNER: Imports scanned data from the barcode scanner into Pro Fund Accounting.

INVENTORY POST: This is used to enter the charges and receipts for stock items.

INVENTORY REPORTS: Choose which reports you want to run/print.

PURCHASE ORDER CALC: Generates purchase orders for inventory items if there are fewer than the minimum quantity required in stock. For this tool to work, minimum quantities and vendors must be specified in the Inventory menu item.

PURCHASE ORDERS: Process to post your purchase orders.

INVENTORY: This is used to set up, modify, delete, and track inventory items.

CHANGE INVENTORY CODE: This is used to change the identification code for an inventory item. It will also adjust all history for the item.

PRINT BARCODE LABELS: This utility allows you to print barcodes for inventory items.

PRINT BARCODE LABELS FOR JOURNAL: This is used to print barcode labels for inventory received in a journal.

SET INVENTORY START INFORMATION: This utility is used to modify the starting information values for existing inventory items.

.png)

1099 FORMS: This menu item is used to process your 1099 forms for any year.

PAY INVOICES: The process to pay all or some of your invoices and gives you an option to choose which invoices to pay and which invoices to hold until a future date.

PAYABLES POST: This menu item is used to enter an invoice.

PAYABLES REPORTS: Choose which report you would like to run/print.

VENDORS: This menu item is used to enter all the vendor information required by Pro Fund Accounting.

RENUMBER CHECKS: This utility is used to renumber a group of checks or a single check with a new starting check number. Used when checks are damaged in the printer, lost, etc.

TIN VERIFY: Allows you to verify that a vendor's name and tax identification number, TIN, match IRS records.

UNPAY INVOICES: This utility will unpay (undo) all the invoices in a journal that was created by the Pay Invoices menu item.

VOID CHECKS: Gives you the ability to void checks.

.png)

BANK CALCULATION: This menu item is used to calculate and add hours to your employees time banks.

DIRECT DEPOSIT: Creates the text file needed for electronically transferring employee paychecks to a bank or credit union account.

IMPORT TIMECARDS: This menu item is used to import approved time cards into Pro Fund Accounting.

PAYROLL CALCULATION: Takes the posted earnings for your employees and calculates all the deductions you have specified.

PAYROLL INFORMATION: Allows you to enter the information for a payroll cycle.

PAYROLL POST: Used to post labor and equipment entries.

PAYROLL REPORTS: Choose which reports you want to run/print.

QUARTERLY TAX REPORTS: Choose which reports you want to run/print.

PAYROLL TAX REPORTS: Choose which reports you want to run/print.

THIRD PARTY PAY: This menu item is used if your employers received any pay from a third party and the third party does not issue any required W2's, you will need to make entries for the pay that was from the third party.

W2 FORMS: Uses Employee Maintenance records to generate W2 forms. For this menu item to work properly, deduction information in the Deduction Types menu item must be correct. Employee Maintenance records should also be up-to-date.

AUTHORIZATION ZONES: Part of the MyWork Timecard system, this tool allows you to alter the geographical areas where devices are authorized to use the MyWork Time Clock feature.

BANK TYPES: An optional payroll feature in Pro Fund Accounting that allows a municipality to track earned and used hours.

BENEFITS:

DEDUCTION ADDRESS: Allows you to specify the name and address printed on a payroll deduction check.

DEDUCTION TYPES: Allows you to create different deductions to use in your payroll.

EMPLOYEES: This menu item is used to set up and update all information pertaining to an employee.

EQUIPMENT GROUPS: Allows you to create new equipment groups and modify existing equipment groups for use in payroll.

PAYROLL DEPARTMENTS: Allows you to create departments for groups of employees. Pro Fund Accounting provides many payroll reports showing department information.

PAYROLL TYPES: Allows you to create different payroll types.

PAYROLL YEAR DATES: Allows you to specify the starting earning date for the new year.

SUPERVISORS: Allows you to select the primary and secondary employees for each supervisor. Each employee can only have one primary supervisor but many secondary supervisors. A supervisor can only be a primary or a secondary for any employee, not both.

TIMECARD PERMISSIONS: Allows you to specify what options employees have access to while using MyWork to enter time cards. You can specify which templates, payroll types, inventory, and equipment will be available to each employee.

TIMECARD TEMPLATES: These are used by the Pro Fund Accounting Timecard systems. These templates help your employees to organize and select the appropriate accounting number to use.

CHANGE EMPLOYEE NUMBER: This utility is used to change or renumber an employee number.

CHANGE HOURS PER DAY: This utility is used to change the number of work hours per day for groups of employees.

EXPORT PAYSTUBS: A utility to email pay stubs to your employees.

INITIALIZE OVERTIME: This utility will reset overtime equalization fields for a given date. Its designed for locations that use overtime equalization calculations.

MERS EXPORT FILE: This utility is used to generate upload files for the Municipal Employees Retirement System.

MISSION SQUARE EXPORT FILE:

PAYROLL FUND BREAKDOWN: Creates detailed data for the Payroll Fund Breakdown report.

RENUMBER PAYROLL CHECKS: This utility can be used to correct check numbers in the system that do not match the numbers on the printed checks.

SSN VERIFY: Generates a file to upload to the Social Security Administration's website to verify employee's social security numbers.

UNCALCULATE BANKS: This utility is used to remove a previous bank calculation.

UNCALCULATE PAYROLL DEDUCTIONS: This utility allows you to uncalculate the payroll so you can modify payroll post journals and properly correct payroll errors.

UNIMPORT TIMECARDS: This utility is used to unimport time cards from Pro Fund Accounting. This will remove the time card record from the payroll journal but will not change the approved status of the time card.

VIEW CURRENT EMPLOYEE EVENTS: Shows date information about your employees.

VIEW TIME CLOCK ACTIVITY: This utility shows a chart of clock-in and clock-out times for employees.

VIEW TIMECARDS: Allows you to view details of employee time cards submitted in MyWork.

ZERO FILL EMPLOYEE NUMBERS: Allows you to set the number of digits you want your employee numbers to be, anywhere from three to nine digits.

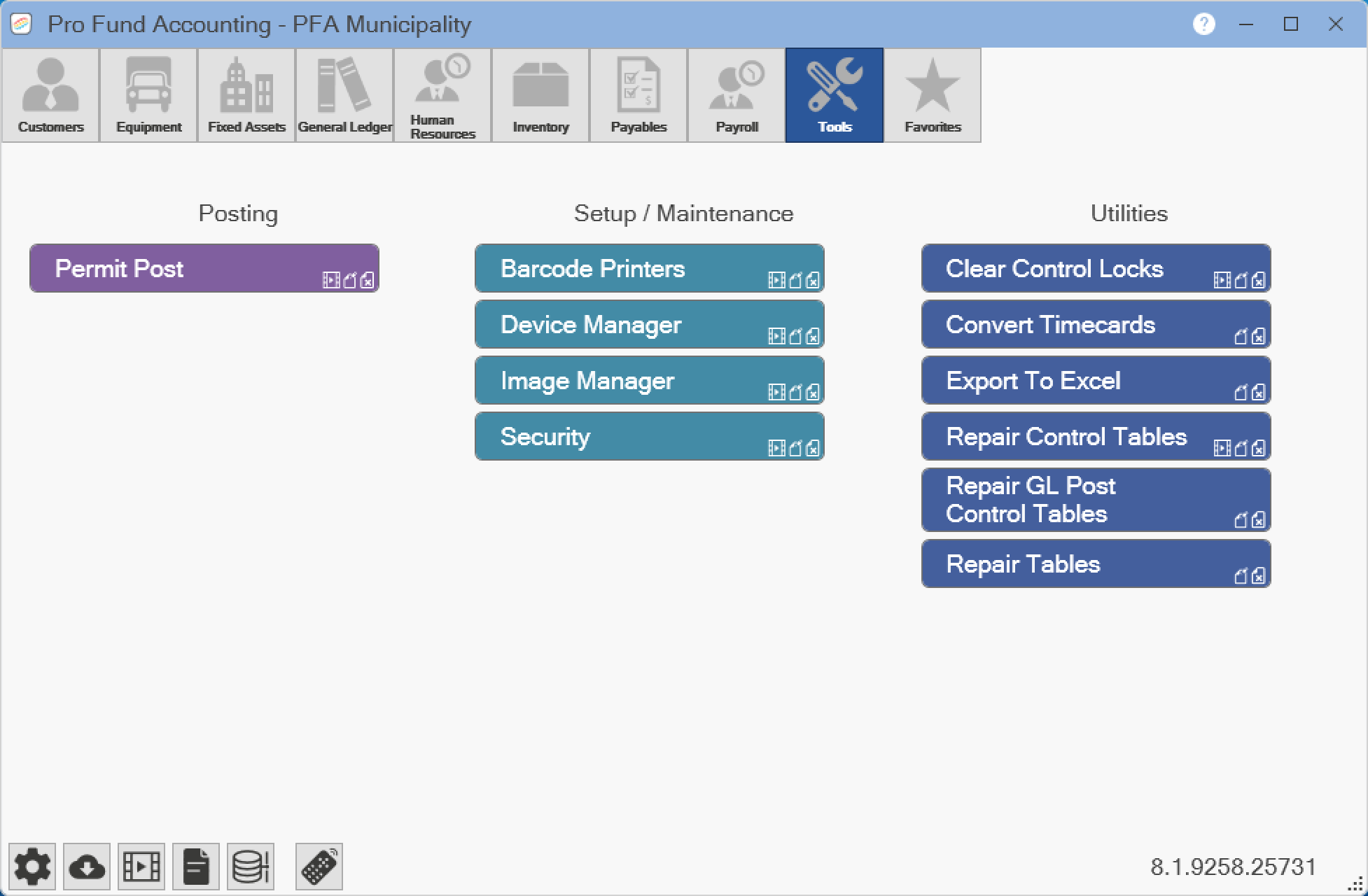

PERMIT POST: This is used to enter and track information for (road) permits.

BARCODE PRINTERS: This is used to configure the barcode printer that will be used with Pro Fund Accounting.

DEVICE MANAGER: This is used to manage external devices that connect to Pro Fund Accounting and to pair new devices.

IMAGE MANAGER: In PFA Works, you have the ability to attach pictures of your employees, equipment, inventory, signatures, and logos.

SECURITY: A comprehensive security system that allows you to configure access rights to each menu item and report. Pro Fund Accounting provides view, update, and delete options for each of the menu items and allow or deny options for each report.

CLEAR CONTROL LOCKS: Unlocks a menu item and resets a journal status.

CONVERT TIMECARDS: Converts the imported PFA Works time cards to the MyWork time cards.

EXPORT TO EXCEL: Allows you to export any data from Pro Fund Accounting to an Excel spreadsheet. To use this tool you will need to contact Cogitate support to set up.

REPAIR CONTROL TABLES: This menu item will rebuild your control tables, clears the DedCalc table for any incomplete payroll calculations, clears the BankCalc table for any incomplete bank calculations and clears the APPay table for any incomplete accounts payable payment journals.

REPAIR GL POST CONTROL TABLES: This option will rebuild your General Ledger Post control tables.

REPAIR TABLES: This option will repair locked tables or fix miscellaneous errors.

For those menu items that you use the most often, you can add them to your Favorites module so you only have to go to one place for more items.

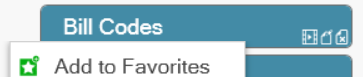

To choose an item to show up in your Favorites module, go to that particular menu item, ex. Customers, right-click on the item and choose ADD TO FAVORITES.

Once you've chosen that menu item, a STAR will show up next to the item you've chosen letting you know that it is in your favorites.

![]()

If you want to DELETE the item from the Favorites module, right-click on that item - IN THE FAVORITES MODULE - and choose REMOVE FROM FAVORITES. Once that is done, it will no longer show up in your Favorites, and on the menu item that it pertains to, it will no longer have a star next to it.

.png)